European Insurers In the first half of this year, several major European insurers reported impressive profits, marking a significant rebound from previous economic strains. This surge in profitability is attributed to a combination of higher insurance premiums, improved investment returns due to rising interest rates, and strategic adjustments following a period of heightened claims. This article delves into the factors driving these profits and the outlook for the insurance industry.

Noteworthy Financial Performance

Allianz Surpasses Expectations

Germany’s Allianz has been a standout performer, with a 7.5% increase in second-quarter net profit. The company’s solid financial results have positioned it well to meet its full-year targets. Allianz’s success is attributed to both its strategic premium hikes and its robust investment portfolio.

Zurich Insurance Sets Records

Zurich Insurance also reported record profits and indicated that it is likely to surpass its 2025 financial targets. The company’s impressive performance highlights the benefits of its premium increases and effective risk management strategies.

Munich Re and Beazley Thrive

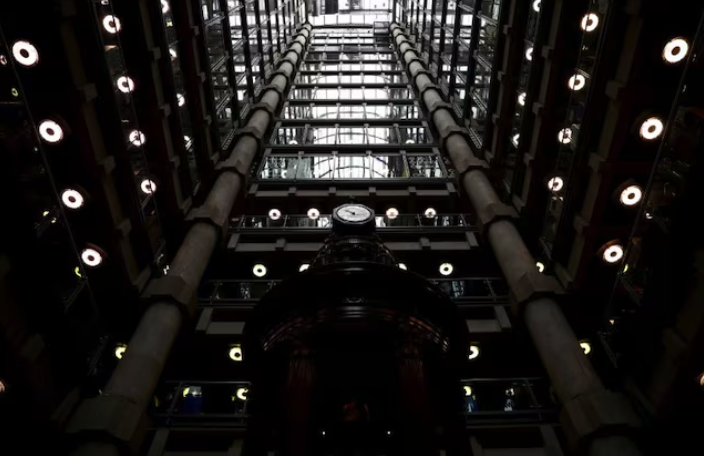

German reinsurer Munich Re has shown promising results, suggesting it may exceed its full-year guidance. Meanwhile, Lloyd’s of London insurer Beazley has seen its pretax profits nearly double, reaching record highs and prompting an upward revision of its outlook. Beazley’s performance was notably stronger than analysts’ expectations, boosting its share price by 12%.

Factors Driving Profitability

Premium Increases

The insurance industry has experienced a significant rise in premiums due to various global challenges, including the COVID-19 pandemic, geopolitical conflicts, and natural disasters. Insurers have leveraged these higher premiums to recover from previous losses and improve their financial standing.

Rising Interest Rates

Higher interest rates have positively impacted insurers’ investment portfolios. After years of struggling with ultra-low or negative interest rates, the recent uptick has provided insurers with a much-needed boost in investment income.

Increased Demand for Life Insurance

The pandemic has also spurred a rise in demand for life insurance as individuals seek to secure financial protection in uncertain times. This increased demand has contributed to the overall profitability of insurers.

Strategic Adjustments and Market Conditions

Policy Adjustments and Risk Management

In response to unexpected claims and financial strains from previous years, many insurers have revised their policies. They have increased premiums and reduced exposure to high-risk areas, such as regions affected by war, disease, or severe natural disasters. These strategic adjustments have helped insurers manage their risk better and reduce costly claims.

Global Insurance Rate Trends

Global commercial insurance rates have been rising steadily for 26 consecutive quarters before stabilizing in the second quarter of this year, according to Marsh, an insurance broker and risk adviser. This trend reflects the insurers’ efforts to align their pricing with the increased risk environment.

Challenges and Caution Moving Forward

Natural Catastrophes and Market Volatility

Despite the strong financial performance, insurers remain cautious. Munich Re’s CEO Joachim Wenning has emphasized the uncertainty surrounding natural disasters, such as the current active U.S. hurricane season. Similarly, Zurich’s share price was affected by concerns over potential natural catastrophe losses, despite the company’s strong financial results.

Concerns Over Public Debt

Recent market volatility and high public debt levels have raised concerns among insurers. Allianz’s CEO, Oliver Baete, has highlighted the “really scary” levels of public debt, which could impact future market stability and financial performance.

Conclusion

European insurers are enjoying a period of significant profitability, driven by higher premiums, improved investment returns, and strategic policy adjustments. While the sector has navigated a challenging landscape marked by global crises and natural disasters, it has adapted effectively and capitalized on favorable market conditions. However, ongoing challenges such as natural catastrophes and market volatility continue to pose risks, prompting insurers to proceed with caution.

FAQs

1. What factors contributed to the recent profit increases for European insurers?

European insurers have seen profit increases due to higher premiums, improved investment returns from rising interest rates, and increased demand for life insurance.

2. How have rising interest rates affected insurers’ financial performance?

Rising interest rates have boosted insurers’ investment income, which had been negatively impacted by previous ultra-low or negative rates.

3. Why are insurers cautious despite strong financial results?

Insurers remain cautious due to ongoing risks such as natural catastrophes, market volatility, and high public debt levels.

4. What strategic changes have insurers made in response to recent challenges?

Insurers have raised premiums, reduced exposure to high-risk areas, and adjusted their policies to manage risk better and mitigate costly claims.

5. How did the recent U.S. hurricane season impact insurers?

Concerns about the active U.S. hurricane season have affected insurers’ share prices and added to the cautious outlook despite strong financial results.