US Gasoline Stocks latest report from the Energy Information Administration (EIA) has brought notable movements in the US energy market, with contrasting trends observed in gasoline and crude oil stocks.

Crude Oil Stocks: Unexpected Build-Up

According to the EIA report, US crude oil stocks witnessed an unexpected build-up of 1.4 million barrels last week, reaching a total of 448.5 million barrels. This figure deviated from analysts’ expectations, who anticipated a build-up of 2.4 million barrels.

Analysts’ Projections vs. Actual Figures

The variance between analysts’ projections and actual figures highlights the inherent volatility and unpredictability of the oil market, influenced by various factors such as geopolitical tensions, supply disruptions, and demand fluctuations.

US Gasoline Stocks Significant Decline

In contrast to the build-up in crude oil stocks, gasoline inventories experienced a significant decline. Gasoline stock plummeted by 4.5 million barrels, reaching a total of 239.7 million barrels.

Implications of Gasoline Stock Decline

- Supply-Demand Dynamics:

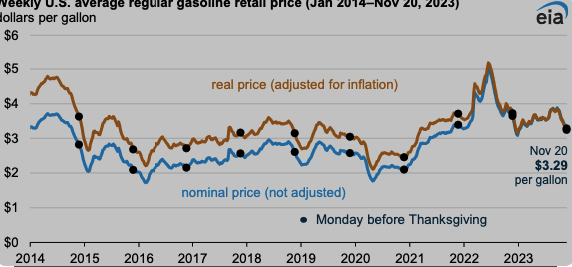

- The sharp decline in gasoline stocks suggests a tightening of supply-demand dynamics in the gasoline market, potentially leading to upward pressure on gasoline prices.

- Seasonal Factors:

- Seasonal variations, such as increased travel demand during holidays or summer months, could have contributed to the decline in gasoline stocks as consumers ramp up their driving activities.

Distillate Stocks: Decline Observed

Similar to gasoline, distillate stocks also witnessed a decline, albeit slightly less pronounced. Distillate inventories fell by 4.1 million barrels to a total of 117 million barrels.

Factors Influencing Distillate Stocks

- Demand Dynamics:

- Distillates, including diesel and heating oil, are essential fuels for transportation and heating purposes. The decline in distillate stocks may reflect increased demand in these sectors.

- Industrial Activity:

- Distillates are also widely used in industrial applications. A decline in distillate stocks could indicate heightened industrial activity, signaling economic growth and expansion.

Conclusion

The latest EIA report showcases contrasting trends in US energy stocks, with a surprising build-up in crude oil inventories alongside significant declines in gasoline and distillate stocks. These dynamics underscore the complex interplay of supply, demand, and market sentiment within the energy sector.

Frequently Asked Questions (FAQs)

- Why did US crude oil stocks see a build-up despite analysts’ expectations?

- The build-up in crude oil stocks could be influenced by various factors, including production levels, import/export dynamics, and geopolitical tensions.

- What are the implications of the decline in gasoline stocks?

- A decline in gasoline stocks suggests a potential tightening of supply-demand dynamics, which could lead to upward pressure on gasoline prices.

- How do seasonal factors affect gasoline inventories?

- Seasonal variations, such as increased travel demand during holidays or summer months, can impact gasoline inventories as consumers adjust their driving habits.

- What factors contribute to the decline in distillate stocks?

- Factors such as increased demand for transportation and heating purposes, as well as heightened industrial activity, can contribute to the decline in distillate stocks.

- What does the latest EIA report indicate for the US energy market?

- The contrasting trends in crude oil, gasoline, and distillate stocks underscore the dynamic nature of the US energy market, influenced by various economic, geopolitical, and seasonal factors.