Bitcoin Bulls has been experiencing an impressive rally, with its price surging by over 40% in just four weeks, nearing its all-time high of nearly $69,000. However, as the cryptocurrency market continues its bullish run, analysts warn that short-term traders might be entering the party too late.

Understanding RSI Signals

Before delving into the specifics, it’s essential to comprehend the Relative Strength Index (RSI) and its significance in trading. Developed by J. Welles Wilder, RSI is a momentum indicator used to measure the speed and change of price movements over a set period, typically 14 days. A reading above 70 indicates overbought conditions, suggesting a potential price correction.

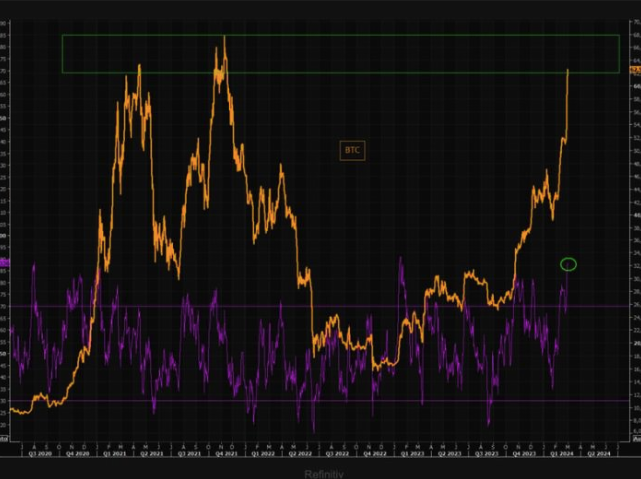

Analysis of Bitcoin’s Current RSI

Recent analysis from The Market Ear highlights Bitcoin’s RSI reaching a staggering 88, signaling extreme overbought conditions. Analysts caution against chasing the rally at this point, as historically, such high RSI levels have preceded price corrections.

Implications for Short-Term Traders

For short-term traders looking to capitalize on Bitcoin’s momentum, the current RSI levels present a risky proposition. Jumping into the market now could lead to losses if a correction occurs.

Historical Context of RSI and Bitcoin Price

Comparing the current RSI levels with previous instances when Bitcoin traded above $60,000 reveals unprecedented territory. While RSI can stay above 70 for extended periods during strong bull markets, caution is warranted, considering the current extreme levels.

Importance of RSI in Trading

While RSI provides valuable insights, it’s essential to recognize its limitations. Market dynamics can sometimes defy RSI readings, emphasizing the importance of a comprehensive trading strategy.

Long-Term Investment Perspective

For long-term investors, short-term price fluctuations driven by RSI signals hold less significance. Instead, focusing on fundamental factors like halving events and institutional adoption remains crucial.

Factors Contributing to Bitcoin’s Bullish Outlook

Despite short-term uncertainties, Bitcoin’s long-term prospects remain bullish. Factors such as supply dynamics and institutional interest continue to fuel optimism among investors.

Conclusion

In conclusion, while Bitcoin’s recent rally is impressive, caution is advised for short-term traders considering the extreme overbought conditions indicated by RSI. Long-term investors should stay focused on the fundamentals driving Bitcoin’s upward trajectory.

FAQs

- What is the significance of RSI in Bitcoin Bulls trading? RSI serves as a momentum indicator, highlighting overbought or oversold conditions in the market, aiding traders in making informed decisions.

- How do short-term traders interpret RSI readings? Short-term traders view high RSI readings as potential signals for a market correction, prompting them to adjust their trading strategies accordingly.

- Can RSI accurately predict short-term price movements? While RSI provides valuable insights, its predictive power is limited, as market dynamics can sometimes defy traditional indicators.

- What factors contribute to Bitcoin’s long-term bullish outlook? Factors such as supply dynamics, institutional adoption, and macroeconomic trends contribute to Bitcoin’s long-term bullish narrative.

- How should investors navigate market volatility driven by RSI signals? Investors should maintain a long-term perspective, focusing on the underlying fundamentals of Bitcoin rather than reacting to short-term price fluctuations dictated by RSI readings.