Hedge Funds in 2023 unfolded, global found themselves navigating through wild market swings, grappling with unexpected rebounds in government bonds, and weathering the impact of macroeconomic events. The intricate dance of high inflation, ongoing rate hikes, and a looming bank crisis created a challenging backdrop for hedge funds worldwide. In this article, we delve into the story of hedge funds in 2023 through four revealing graphs

shedding light on the highs and lows of the sector and how performance contrasts with previous years.

1. Events That Impacted Hedge Funds in 2023

The first graph illustrates the significant events that influenced throughout 2023. From wild market swings to unexpected rebounds in government bonds, the sector faced a multitude of challenges. The data

sourced from prime brokerage notes, provides a comprehensive overview of the impactful events that shaped the narrative for hedge funds in the past year.

2. Crowded Trades Were the Best Trade

The second graph zooms in on the impact of crowded trades, particularly in North America

and how they shaped hedge fund profitability. Crowded trades proved to be the most profitable since 2020, according to prime brokerage data. The graph highlights the surge in hedge fund crowding, reaching its highest on record. Asset managers bet heavily on the “Magnificent 7” tech stocks, contributing to inflated portfolio returns. Megacap growth and technology stocks, including giants like Microsoft and Amazon.com, accounted for a significant portion of the aggregate fund long portfolio, driving outsized returns for the funds.

3. Paid to Be Long: Equities in Focus

The third graph emphasizes the profitability of being long in 2023, with stock bets anticipating a rise in equities. According to Morgan Stanley, being long paid off handsomely, with stock bets on the rise contributing positively to portfolio performance. Conversely, short positions detracted from overall performance. The graph provides insights into the dynamics of long and short positions within hedge fund portfolios, revealing the strategic choices made by fund managers in response to market conditions.

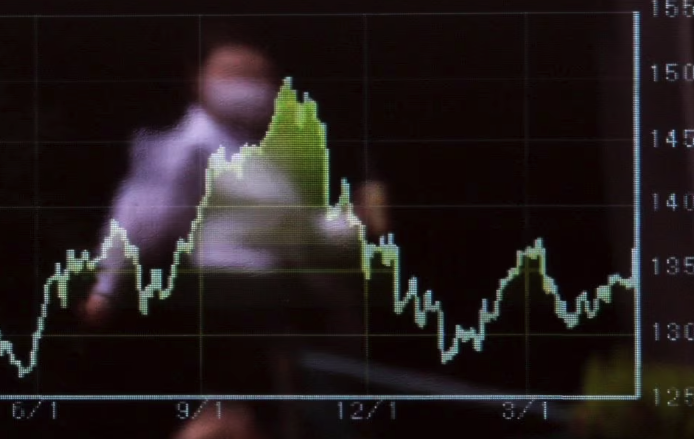

4. The Volatility Landscape: Navigating Highs and Lows

The fourth graph offers a visual representation of the volatility landscape experienced by hedge funds in 2023. Wild market swings, a hallmark of the year, are captured in this graph, showcasing the challenges faced by fund managers in maintaining stability and navigating through unpredictable market conditions. The graph provides a glimpse into the intricate dance between risk and reward that defined the year for hedge funds.

In conclusion, the graphs presented here offer a comprehensive visual narrative of the hedge fund landscape in 2023. From the impact of major events to the profitability of crowded trades and strategic choices in equities

each graph contributes to the story of a dynamic and challenging year for hedge funds globally.

FAQs (Frequently Asked Questions)

- Q: What events had a significant impact on hedge funds in 2023?

- A: The first graph illustrates the events that influenced hedge funds

including wild market swings and unexpected rebounds in government bonds.

- A: The first graph illustrates the events that influenced hedge funds

- Q: Why were crowded trades particularly profitable for hedge funds in 2023?

- A: The second graph highlights the profitability of crowded trades, especially in North America

with asset managers heavily betting on tech stocks like Microsoft and Amazon.com.

- A: The second graph highlights the profitability of crowded trades, especially in North America

- Q: How did being long in equities contribute to hedge fund performance in 2023?

- A: The third graph indicates that being long in equities paid off, contributing positively to portfolio performance

while short positions detracted from overall results.

- A: The third graph indicates that being long in equities paid off, contributing positively to portfolio performance

- Q: What does the fourth graph capture about hedge funds in 2023?

- A: The fourth graph visualizes the volatility landscape experienced by hedge funds in 2023

showcasing the challenges and opportunities amid wild market swings.

- A: The fourth graph visualizes the volatility landscape experienced by hedge funds in 2023