Navigating Global Markets the intricate dance of global financial markets, every move is scrutinized for its potential impact. Today’s scenario unfolds against a backdrop of slipping global shares and advancing oil prices. Let’s delve into the key developments shaping the market landscape.

Global Shares Retreat Amid Dollar Strength

H1: Overview

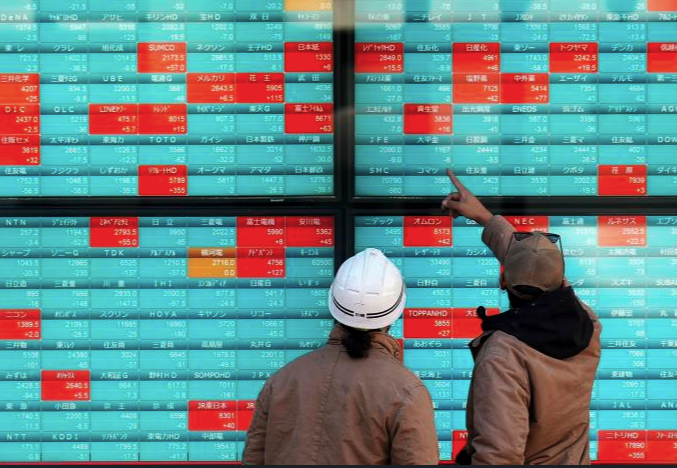

Global shares took a step back on Friday, with investors closely monitoring export-related Tokyo stocks, which received a boost as the dollar strengthened against the Japanese yen.

H2: U.S. Futures and Oil Prices

U.S. futures experienced a modest dip, contrasting with the upward trajectory of oil prices that surged by nearly $1. The juxtaposition of these movements sets the stage for a nuanced market sentiment.

Economic Pulse: U.S. Labor Department Report

H3: Anticipation Builds

Investors are on edge, awaiting the release of a comprehensive jobs market report from the U.S. Labor Department later in the day. Economists are bracing for data that may indicate a slowdown in U.S. hiring, projected to drop to 160,000 jobs from 199,000 in November.

H4: Balancing Act

The overarching hope is that the U.S. economy maintains sufficient strength to ward off a recession without compromising the progress made in curbing inflation. The Federal Reserve closely monitors these trends, contemplating the potential necessity of interest rate cuts.

Market Dynamics: Impact of Rate Cuts

H5: Boost for Investments

Rate cuts, if implemented, could inject vigor into stock and investment markets. Simultaneously, they play a pivotal role in alleviating pressure on both the economy and the financial system.

H6: Wait-and-See Sentiments

Market analysts, like Yeap Jun Rong from IG, suggest that sentiments are adopting a wait-and-see stance. The prospect of a substantial weakening of the U.S. labor market would be a catalyst justifying market expectations of a rate cut.

Navigating Global Markets Movements

H7: European Indices

In Europe, the CAC 40 in France saw a decline of nearly 0.7%, standing at 7,401.13. Germany’s DAX slipped by 0.5% to 16,532.37, and the FTSE 100 in Britain dropped 0.6% to 7,677.77.

H8: Asian Trading

Asian markets displayed mixed results. Japan’s Nikkei 225 gained 0.3%, reaching 33,377.42, fueled by a weakened yen benefiting major exporters like Toyota Motor Corp. However, Hong Kong’s Hang Seng fell by 0.7% to 16,535.33, and the Shanghai Composite skidded 0.9% to 2,929.18.

H9: Down Under and Beyond

Australia’s S&P/ASX 200 experienced a marginal 0.1% decline, settling at 7,489.10. South Korea’s Kospi lost 0.4%, closing at 2,578.08.

Currency Navigating Global Markets and Oil Prices

H10: Currency Fluctuations

In the currency realm, the U.S. dollar rose to 145.01 Japanese yen from 144.63 yen, while the euro fell to $1.0919 from $1.0947.

H11: Oil Market Update

Benchmark U.S. crude added 82 cents, reaching $73.01 a barrel, and Brent crude, the international standard, rose by 73 cents to $78.34 a barrel in electronic trading on the New York Mercantile Exchange.

Conclusion

As global markets navigate the intricate interplay of economic indicators and geopolitical events, investors remain vigilant. The delicate balance between economic strength, inflation control, and potential rate cuts sets the stage for a dynamic and uncertain landscape.

FAQs

- Q: What is the significance of the U.S. Labor Department report?

- A: The U.S. Labor Department report is a crucial economic indicator, providing insights into the jobs market. Investors are keenly awaiting this data to gauge the health of the U.S. economy.

- Q: How do rate cuts impact the financial markets?

- A: Rate cuts can boost prices for stocks and other investments while relieving pressure on the economy and financial system. They are closely monitored for their potential to influence market dynamics.

- Q: What are the notable movements in European indices?

- A: European indices experienced declines, with France’s CAC 40, Germany’s DAX, and Britain’s FTSE 100 all showing negative movements.

- Q: How did Asian markets perform?

- A: Asian markets exhibited mixed results, with Japan’s Nikkei 225 gaining, Hong Kong’s Hang Seng falling, and the Shanghai Composite experiencing a decline.

- Q: What were the currency fluctuations and oil price movements?

- A: The U.S. dollar strengthened against the Japanese yen and the euro, while oil prices saw an increase, with benchmark U.S. crude and Brent crude both rising in electronic trading.