Powell Reiterates Fed reaffirmed the central bank’s cautious approach towards adjusting interest rates. Despite growing speculation about potential rate cuts, Powell emphasized the Fed’s stance of not rushing into such measures.

Jerome Powell’s Remarks on Fed’s Stance

Powell reiterated the Fed’s reluctance to hastily reduce interest rates during a speech at the San Francisco Fed. He underscored the importance of maintaining a vigilant stance until there is sufficient confidence regarding inflation trajectories.

Analysis of Inflation Data

Recent inflation figures indicate a notable moderation, aligning closely with the Fed’s expectations. Powell acknowledged the latest inflation statistics but emphasized the necessity of waiting for sustained progress towards the 2% inflation target before considering rate adjustments.

Fed’s Monetary Policy Stance

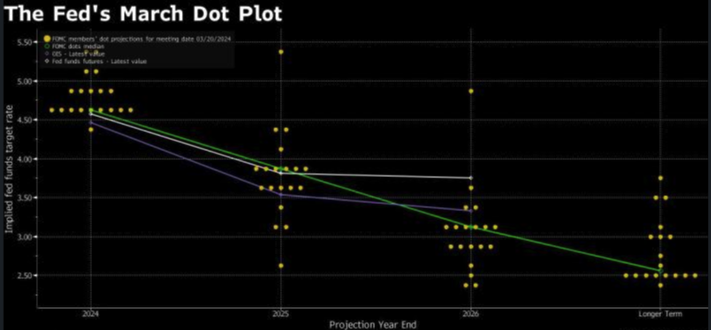

The Federal Reserve has maintained short-term interest rates at historically high levels. Despite this, a majority of policymakers foresee potential rate cuts in 2024, reflecting a cautious optimism about economic trends.

Economic Resilience Amid High Rates

Contrary to concerns about the impact of elevated rates, the US economy has demonstrated resilience. Consumer spending has surpassed expectations, buoyed by robust employment figures.

Powell’s Response to Economic Indicators

Powell remains vigilant about labor market indicators, highlighting the importance of monitoring any unexpected weakening. While he downplays the likelihood of a recession, he acknowledges the need for readiness to respond to evolving economic conditions.

Governor Christopher Waller’s Perspective

Governor Waller suggests that disappointing inflation data may necessitate a reevaluation of rate adjustment strategies. His remarks underscore the complexities involved in navigating monetary policy amid uncertain economic signals.

Fed’s Approach Amid Inflation Decline

Fed officials remain committed to a nuanced approach as inflation gradually recedes. While acknowledging the potential benefits of lower rates, they are cautious about the timing and extent of such adjustments.

Conclusion

Jerome Powell’s reaffirmation of the Fed’s stance underscores the delicate balance between fostering economic growth and maintaining price stability. As the Fed continues to navigate evolving economic dynamics, a cautious approach remains paramount.

FAQs:

- Will the Fed cut interest rates soon?

- The Fed has indicated a willingness to consider rate cuts but remains cautious about the timing, waiting for sustained progress on inflation.

- How does inflation data influence Fed decisions?

- Inflation data provides crucial insights into the health of the economy and informs the Fed’s monetary policy decisions, particularly regarding interest rates.

- What factors contribute to the Fed’s cautious stance?

- The Fed considers various economic indicators, including consumer spending, labor market conditions, and inflation trends, in determining its policy stance.

- What impact do rate adjustments have on the economy?

- Rate adjustments can affect borrowing costs, consumer spending, and investment decisions, thereby influencing overall economic activity.

- How does the Fed balance economic growth and price stability?

- Powell Reiterates Fed aims to achieve its dual mandate of maximum employment and stable prices by adjusting monetary policy in response to prevailing economic conditions.