In a dynamic day for U.S. equities, the S&P 500 marked its second consecutive session of gains, driven by Federal Reserve comments hinting at potential interest rate cuts in the coming year. Positive retail sales data further fueled the market’s optimism, with the S&P 500 rising by 0.3%, and the Dow extending its record-high streak. Bond yields also experienced a decline, with the 10-year Treasury note yielding below 4%.

Solar Stocks Bask in the Sun

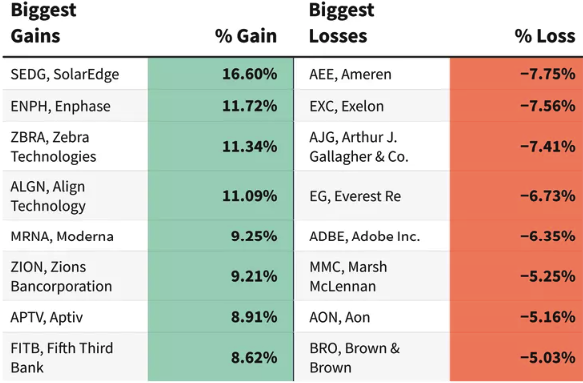

The standout performers of the day were solar power companies, with lower borrowing costs making them more enticing for investors. Leading the charge for the S&P 500 was SolarEdge Technologies (SEDG), witnessing an impressive gain of 16.6%. Enphase Energy (ENPH) and First Solar (FSLR) also joined the rally, surging by 11.7% and 8%, respectively. This surge in solar stocks highlights the market’s positive response to the prospect of lower interest rates.

Regional Banks Ride the Lower Rates Wave

Another sector benefiting from the anticipation of lower rates was regional banks. Zions Bancorporation (ZION) took the lead among this group, with shares advancing by 9.2%. The consecutive gains indicate a positive sentiment among investors towards the potential impact of reduced borrowing costs on regional banks.

Moderna’s Vaccine Success Boosts Biotech Stocks

Biotech stocks saw notable activity as well, with Moderna (MRNA) experiencing a 9.2% surge. This jump came on the back of promising results from a study on a skin cancer vaccine developed in collaboration with Merck (MRK). Despite Moderna’s success, Merck’s shares were down by 0.4%, showcasing the nuanced reactions within the biotech sector.

Adobe Faces Headwinds, Sinks in Market

On the flip side, Adobe (ADBE) faced headwinds, posting one of the day’s weakest performances among S&P 500 stocks. The software giant’s shares plummeted by 6.3% following weaker-than-expected 2024 guidance. Adobe also issued a warning about potential significant fines from U.S. regulators related to its disclosure and subscription practices, adding to the market’s concerns.

Cardinal Health Faces Analyst Concerns

Cardinal Health (CAH) witnessed a 5% drop in its shares after Wells Fargo initiated a price target below the current trading value. Analysts expressed concerns about Cardinal’s upcoming contract with UnitedHealth Group’s (UNH) health services provider, Optum. This negative sentiment impacted UnitedHealth Group shares as well, causing a 2.7% decline.

In conclusion, the S&P 500’s movements today were a reflection of the market’s response to both macroeconomic factors, such as potential rate cuts, and company-specific developments. The contrasting performances of solar stocks, regional banks, biotech firms, and software giant Adobe highlight the diverse factors influencing investor sentiment on any given day.