Spot Bitcoin ETF a groundbreaking development, the approval of the spot Bitcoin exchange-traded fund (ETF) earlier this month has sparked anticipation among investors. As Bitcoin becomes more accessible to the general public, attention now turns to the possibility of a spot Ethereum ETF, with potential approval on the horizon.

I. Bitcoin ETF Approval Sets the Stage

The recent approval of the spot Bitcoin ETF has paved the way for increased accessibility to the cryptocurrency market. Investors are optimistic about the potential for Bitcoin to continue its positive momentum, building on the gains it has achieved in recent months.

II. Ethereum’s Turn in the Spotlight

With Bitcoin’s success, focus shifts to Ethereum (CRYPTO: ETH) as the next candidate for a spot ETF. Ethereum, the second most popular cryptocurrency with a market cap of $305 billion, is less than half the value of Bitcoin, which stands at $843 billion.

III. Multiple Applications for a Spot Ether ETF

Several companies, including BlackRock and Ark, have submitted applications for a spot Ethereum ETF. The Securities and Exchange Commission (SEC) is expected to make a decision by May, setting the stage for potential mainstream adoption of Ethereum.

IV. Ethereum’s Rising Value

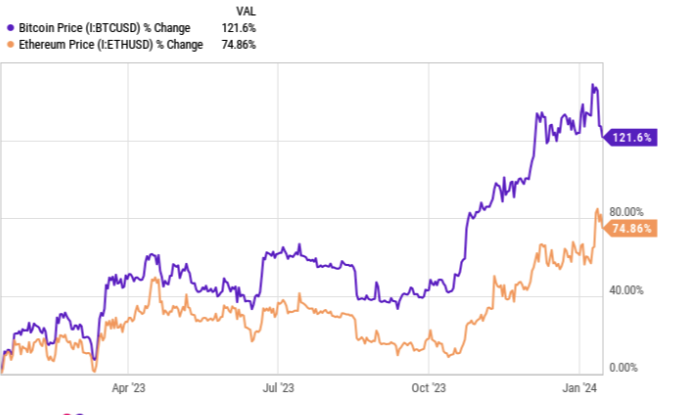

Ethereum’s market value has seen a significant uptrend over the past year, mirroring the trajectory of Bitcoin. The enthusiasm for broader acceptance of cryptocurrencies has positively influenced both digital assets. Investors are closely watching Ethereum’s value, which has experienced notable spikes in recent weeks.

V. Why Approval Timing May Vary

Despite the optimistic outlook, not everyone is convinced that Ethereum’s spot ETF approval is imminent. According to TD Cowen, an approval may not occur until after the U.S. federal election. The rationale is based on the belief that the SEC will want to gain experience from the rollout of the Bitcoin ETF before considering approval for another token, including Ethereum.

VI. Managing Investor Expectations

While excitement surrounds the potential approval of a spot Ethereum ETF, investors should be cautious about expecting an immediate decision by May. The SEC’s careful approach, as demonstrated in the case of the Bitcoin ETF, suggests that regulatory processes may take time. Investors are urged to manage their expectations and not set overly optimistic timelines.

VII. Investing Considerations for Ethereum

Despite potential delays in approval, Ethereum remains a significant player in the crypto space. If investors are bullish on cryptocurrency, now could be an opportune time to consider exposure to Ethereum. Even if approval takes longer than expected, the likelihood of a spot Ethereum ETF approval looks promising. Ethereum’s gains, while trailing behind Bitcoin, may present additional upside potential once approval is granted.

VIII. Navigating Volatility and Risks

As with any cryptocurrency investment, volatility remains a key consideration. While awaiting regulatory decisions, investors should be prepared for market fluctuations. However, with regulators displaying a more positive view of digital currencies and the recent approval of the spot Bitcoin ETF, the overall outlook for cryptocurrencies remains promising.

In conclusion, the green light for the spot Bitcoin ETF has opened the door for potential developments in the crypto market. As attention turns to Ethereum, investors are cautiously optimistic about the prospects of a spot Ethereum ETF. While timelines may vary, the evolving landscape suggests that the broader adoption of cryptocurrencies, including Ethereum, is on the horizon.